All Out: Stock Bond Correlations, VC, Catching Falling Knives, ESG

The Generational Paradigm Shift Taking Over Markets

The common knowledge in finance is that stocks diversify bonds. Like we wrote about last week, when you combine stocks and bonds in a portfolio, the portfolio’s volatility will go down. This comes from two places; bonds have lower volatility than bonds, so mechanically the average of both will be lower than that of stocks. However, bonds tend to have a negative correlation to stocks. Even if stocks and bonds had the same volatility, the portfolio volatility will go down because stocks and bonds will go up and down at different times. However, this assumption doesn’t always hold, and it may be a dangerous assumption to make.

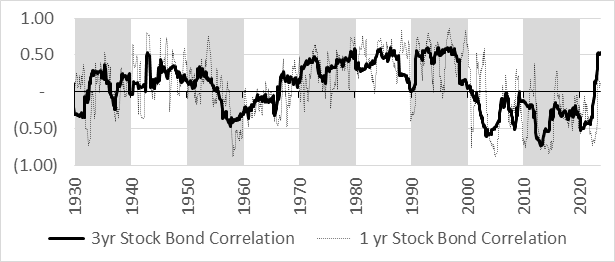

A couple of days ago one of our readers sent an article talking about inflation and stock bond correlations. One of the charts is shows the rolling stock bond correlation since the 1930s.

Like you can see above, most of the time (at least half the time) stocks and bonds are positively correlated. A positive correlation means that both assets move in the same direction. So if they have positive correlation means that if stocks fall bonds won’t provide a hedge and will also fall (technically correlation measures average movement but this approximation is close enough, we’ll leave the details for another All Out). Therefore a fundamental pillar of portfolio construction, bonds diversify bonds, may not always hold up. This is why we have been advocating for additional sources of diversification for some time.

Venture capital funds are mostly just wasting their time and your money

We’re not fans of private equity but we do like venture capital (VC) for a couple of reasons. VC has a very asymmetric return profile. Most VC companies will go to zero but you have the potential to 10X, 100X or even 1000X your money (just ask early Uber investors). Finding these 100Xers is extremely difficult and few people are successful. However if you find 1 then you can essentially lose 100% on another 99 and still break even. That’s the beauty of an asymmetric payoff, you don’t have to be right that often and still make money.

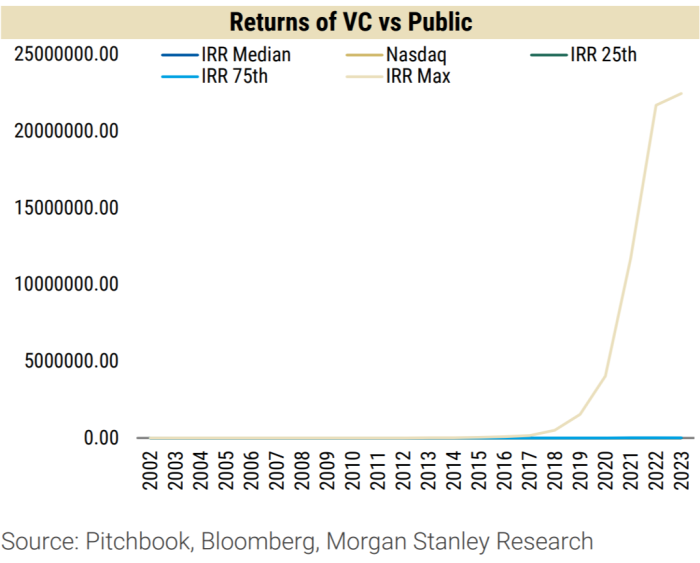

We have a couple of criticisms of this article starting from this graph.

When you have an exponential return like the one shown above it doesn’t make any sense to plot it like this (they should have used a logarithmic scale). All the lines just bunch down around 0 because the beige line is such an outlier. The second issue we have is that they are comparing VC fund IRRs to public company CAGRs, which measure different things and aren’t comparable at all (more on this in a future All Out).

The third issue is that they compare the median VC fund to the median stock. Using the median VC fund makes sense since you cannot invest in an index of all VC funds. So if you were to pick a VC fund at random, then the median is a pretty reasonable approximation as to the return you would expect. But nobody just buys 1 stock, we buy 5, 10, 20, 100 stocks. We buy index funds, whether it’s S&P 500, Nasdaq, whatever. A better comparison would have been to compare the median VC to the return on a stock index. And even better yet, industry and size match these funds to their public market equivalents. So compare tech VC with the Nasdaq instead of the S&P 500, healthcare VC to healthcare stocks and so forth.

But we digress. The meat of the article is that the median VC fund doesn’t generate higher returns than the median stock. So after all fees, costs, lockups, illiquidity etc., it’s better to just pick a stock at random and hold it rather than investing in VC.

So are we going to stop investing in VC? Probably not, we would assume we’re better than a coin flip judging VC investments (even though that’s not our expertise) and we’re still hunting for that 100X 🙂

Where Defaults Loom, This Trading Strategy Is Delivering Big Returns

This is an interesting article talking about buying really unloved assets. Generally, when companies are faced with some sort of adversity, their stocks and bond sell off. This is why when a company announces lackluster earnings or forecasts poor growth, their stocks drop. However, there are cases in which external events may hammer the assets so much that they are fundamentally extremely cheap. Examples are Ukrainian companies after the invasion of Ukraine. There was a lot of uncertainty after the Russian invasion, so these companies sold off heavily. The more uncertain something, is the cheaper the price will be. Investors had no idea what was going to happen in Ukraine, so prices had to drop a lot in order to entice enterprising investors to buy. Well, some of these risks do pay off, like the fund mentioned in the article which has bought up a bunch of debt from Ukrainian companies and it has paid off handsomely. Sure, these companies are probably not doing great, but they are doing better than what was feared a year and a half ago. There’s a saying which is very true that goes “there are no bad stocks, just bad prices”. Even a terribly run company with poor prospects can be a good buy if it’s cheap enough. And even the best run company in the world with extremely exciting prospects can be a bad buy if it’s too expensive.

Why ESG Ratings Are All Over the Map

Evaluating a company’s ESG efforts is very difficult. First of all many companies are not required to report ESG data. Therefore, a lot of the data is gathered through secondary sources or through estimations. We haven’t dug deep into how different ESG scores are constructed and where the data is gathered, but neither have most investors. And this is the crux of our criticism of ESG. We’re all for helping the planet and good governance, good social policies etc. But ESG funds won’t do this for you. If you truly care about the environment then you need to do stuff yourself with your spending dollars and your actions. Don’t just invest in an ESG fund and think you’re making a difference. If you want to invest in ESG sure fine you can, but make sure you don’t just do that and stop doing things that really make an impact.

We’ve been recently exploring creating company rankings using a different methodology, based on human rights. And the data is hard to come by and there are many judgements in how you weight the different variables. There’s no one right way to do it, you just have to justify why you did it the way you did and make sure it makes sense

|

|